Published on 4/2/2024

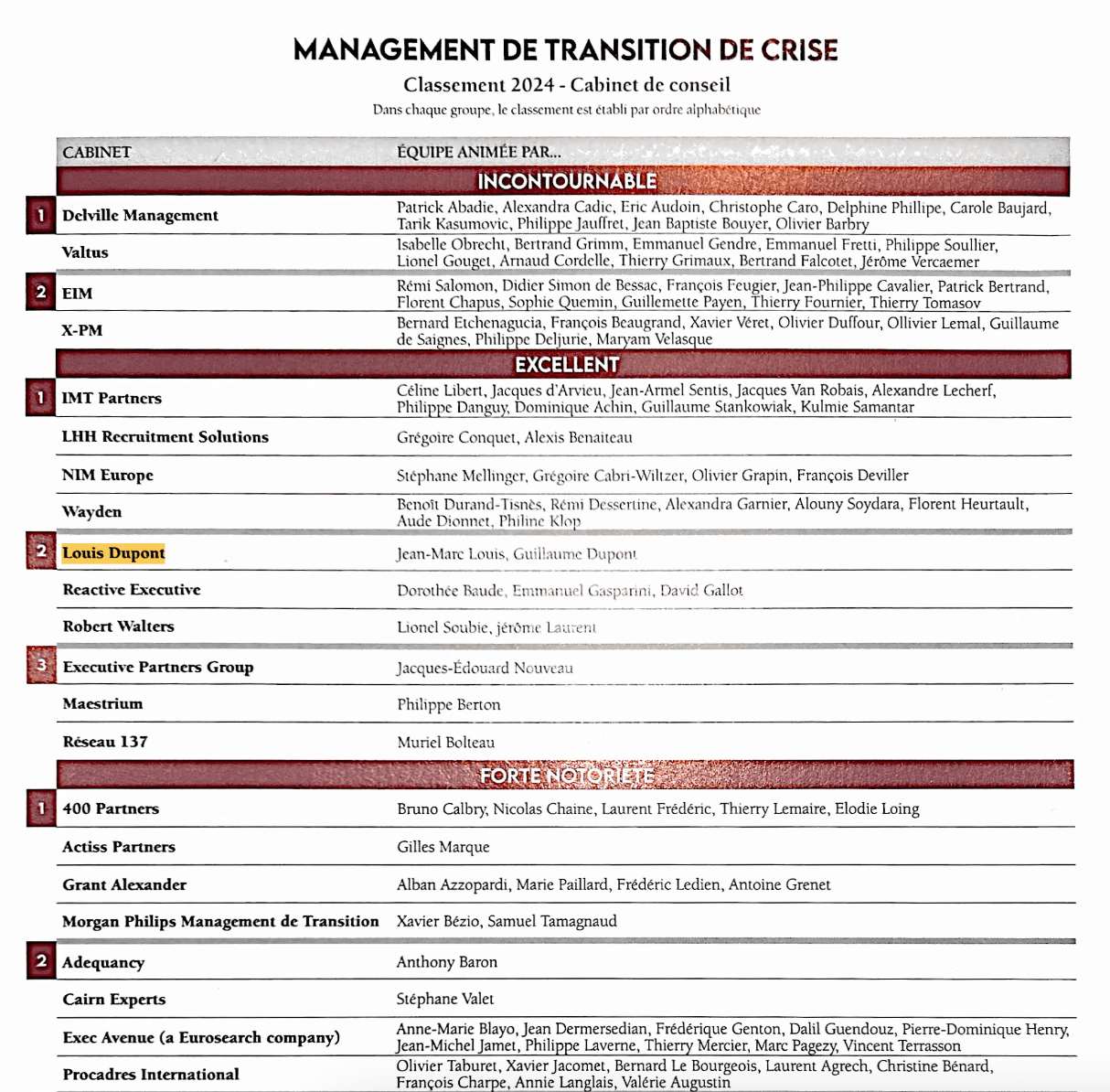

Décideurs Magazine has published the 2024 Ranking: "Restructuring & Companies in Difficulty - Transition Management".

The Décideurs Magazine publishes its annual "Restructuring & Entreprises en difficultés" rankings, which are based on a close-to-the-field analysis and qualitative criteria - specialty by specialty. The rankingent is divided into 4 categories: Unmissable, Excellent, Well-known, Renowned practice.

What is a restructuring assignment?

A restructuring transition assignment is a strategic operation designed to restructure and revitalize a company experiencing financial, operational or strategic difficulties. This type of assignment is generally entrusted to a specialized interim manager, who brings in his or her expertise and outside experience to rapidly identify the problems and draw up and implement an effective recovery plan.

Restructuring interim managers often work under pressure, to tight deadlines, to reverse the company's negative trajectory. Their approach is highly pragmatic and results-oriented, aimed at ensuring the company's short- and long-term viability. In short, a restructuring transition mission is a critical intervention designed to safeguard and transform a company in difficulty, with a view to restoring its competitiveness and profitability.

What are the legal steps involved in restructuring a company?

Restructuring a company involves not only operational and financial strategies, but also compliance with specific legal frameworks. The legal steps vary according to the legislation of the country concerned, but in general they may include :

1. Preliminary analysis and legal audit: Before embarking on restructuring, a preliminary analysis to identify legal issues is essential. This may include an audit of the company's contracts, debts, legal and tax obligations.

2. Stakeholder notification: The law may require the company to inform certain stakeholders (such as employees, creditors, and shareholders) of its intention to restructure. This may include mandatory consultations with employee or union representatives.

3. Filing a restructuring petition (if applicable): In some legal systems, a company may need to file a formal restructuring application with a court or competent authority, especially if it seeks to benefit from legal creditor protections during restructuring.

4. Negotiations and agreements with creditors : Companies undergoing restructuring often have to negotiate with their creditors to restructure debt. These negotiations may be governed by specific legal provisions, notably concerning standstill agreements or repayment plans.

5. Safeguard or reorganization plan : Depending on the legislation, the company may be required to prepare and submit a safeguard or reorganization plan, detailing the measures planned to restore its financial viability. This plan often has to be approved by a court or creditors.

6. Staff restructuring: If restructuring involves staff reductions, the company must follow legal procedures for redundancies, which may include notification, consultation and specific compensation.

7. Asset disposals and divestments: The sale of assets as part of a restructuring may require regulatory approvals or compliance with specific procedures, especially if regulated assets or operating licenses are involved.

8. Finalization and legal follow-up: Once the restructuring process has been completed, there may be additional legal requirements, such as updating commercial registers, notifying tax authorities, or adjusting the company's articles of association.

It is crucial for any company undergoing restructuring to work closely with legal advisors to ensure that all stages of the process comply with current legal and regulatory requirements.

the key stages of corporate restructuring:

The restructuring process, whether financial, operational or strategic, generally follows several key stages to ensure a company's revitalization. These are outlined below:

1. Initial diagnosis : This first stage involves an in-depth assessment of the company's current situation, identifying the root causes of its difficulties. This includes analysis of its financial structure, operations, market strategy and organizational performance.

2. Strategic planning: Based on the diagnosis, a restructuring plan is drawn up, defining short- and long-term objectives, and the strategies for achieving them. This plan may include measures such as debt restructuring, cost reduction, streamlining of operations, or reconfiguration of the product/service offering.

3. Operational restructuring : This phase aims to improve the company's operational efficiency by reorganizing processes, rationalizing activities, and sometimes downsizing. The aim is to make the company more agile and competitive.

4. Financial restructuring: This involves rebalancing the company's capital structure, often by renegotiating debt terms with creditors, seeking new financing, or disposing of assets to generate cash.

5. Implementation and monitoring: The restructuring plan is executed under the supervision of management and/or a specialized interim manager. This stage includes the deployment of restructuring initiatives and rigorous monitoring to ensure that objectives are met.

6. Communication: Throughout the process, transparent and regular communication with stakeholders (employees, partners, creditors, investors) is essential to maintain trust and support the execution of the restructuring plan.

7. Evaluation and adjustment: After implementation, a results assessment is carried out to compare current performance with objectives. Adjustments can be made to the initial plan in response to unforeseen challenges or changes in the external environment.

Each stage of the restructuring process is critical and requires careful attention to ensure the success of the transformation and the sustainability of the company.

What are the advantages of an interim manager in a restructuring assignment?

1. Specialized expertise: Interim managers bring in-depth expertise and experience specifically tailored to the challenges of restructuring. Their knowledge of best practices in similar situations enables an informed and effective approach.

2. Objectivity: As outsiders, they are not influenced by corporate culture, internal politics or power dynamics, enabling them to assess situations impartially and make decisions based on the company's real needs.

3. Agility and speed of action: Interim managers are used to adapting quickly to new environments and acting effectively under tight deadlines. This ability to act quickly is crucial in restructuring situations where time is often a critical factor.

4. Change management: They have solid experience in change management, essential for navigating through periods of transition and ensuring that structural changes are well accepted and integrated within the organization.

5. Leadership: Able to provide strong, reassuring leadership, interim managers inspire confidence and mobilize internal teams during potentially destabilizing periods, ensuring continuity of operations and minimizing disruption.

6. Flexibility : They offer a flexible solution to the company, intervening only for as long as is necessary, which is often a more cost-effective solution than hiring permanent high-level executives with similar skills.

7. Skills transfer: Their time with the company can also be an opportunity for professional development for in-house teams, thanks to the transfer of skills and knowledge, strengthening the company's capabilities over the long term.

8. Focus on results: Interim managers are focused on achieving specific results, with an approach oriented towards short-term objectives and problem-solving, which is particularly relevant in restructuring contexts.

The use of an interim manager in a restructuring context therefore enables the company to navigate more effectively through challenges, implement necessary changes and optimize results while minimizing operational disruption.

What are the differences between a turnaround transition assignment and a restructuring transition assignment?

What do they havein common? Both types of assignment seek to improve the situation of a company in difficulty, require change management expertise, and often involve difficult decisions.

Key differences : Turnaround focuses on the company's long-term recovery and growth, while restructuring aims to solve specific short-term financial or structural problems.

Although turnaround and restructuring missions share a similar goal of rescuing a company, they differ in their scope, duration and specific strategies. The choice between a turnaround or restructuring mission will depend on the company's particular situation and its immediate versus long-term needs

LOUIS DUPONT Transition Management, restructuring specialist:

In an environment where uncertainty and vulnerability prevail, the intervention of LOUIS DUPONT Management is essential.

Would you like to join our network of Transition Managers? https://louis-dupont.com/fr/rejoignez-nous

Do you have a challenge to take up? https://louis-dupont.com/fr/contact

Pascal Somosierra - Associate Director

APPOINTMENT: DAVID YANA

Connecting good people